What Is A Forex Account

What is forex trading?

Forex trading is the process of speculating on currency prices to potentially make a profit. Currencies are traded in pairs, and so by exchanging 1 currency for some other, a trader is speculating on whether one currency will ascension or autumn in value against the other.

The value of a currency pair is influenced by merchandise flows, economic, political and geopolitical events which affect the supply and demand of forex. This creates daily volatility that may offer a forex trader new opportunities.

Online trading platforms provided by global brokers like FXTM mean you tin can buy and sell currencies from your phone, laptop, tablet or PC.

What is an online forex broker?

An online forex broker acts as an intermediary, enabling retail traders to admission online trading platforms to speculate on currencies and their price movements.

Most online brokers volition offer leverage to individual traders, which allows them to control a large forex position with a small deposit. It is important to retrieve that profits and losses are magnified when trading with leverage.

FXTM offers a number of different trading accounts, each providing services and features tailored to a clients' individual trading objectives.

Discover the business relationship that'due south right for you by visiting our account page. If yous're new to forex, y'all tin begin exploring the markets past trading on our demo account, chance-gratuitous.

Why trade forex?

Forex offers many benefits to retail traders.

You can trade around the clock in unlike sessions across the globe, as the forex market place is not traded through a key exchange like a stock market place. This means you can bound on volatility, wherever it happens. High liquidity too enables you lot to execute your orders rapidly and effortlessly.

Trading forex using leverage allows you to open a position past putting upwards merely a portion of the full trade value. Yous can besides become long (buy) or short (sell) depending on whether you retrieve a forex pair'due south value will rising or autumn.

Forex trading offers abiding opportunities across a wide range of FX pairs. FXTM's comprehensive range of educational resources are a perfect way to get started and improve your trading knowledge.

Agreement Currency Pairs

All transactions made on the forex market involve the simultaneous buying and selling of two currencies.

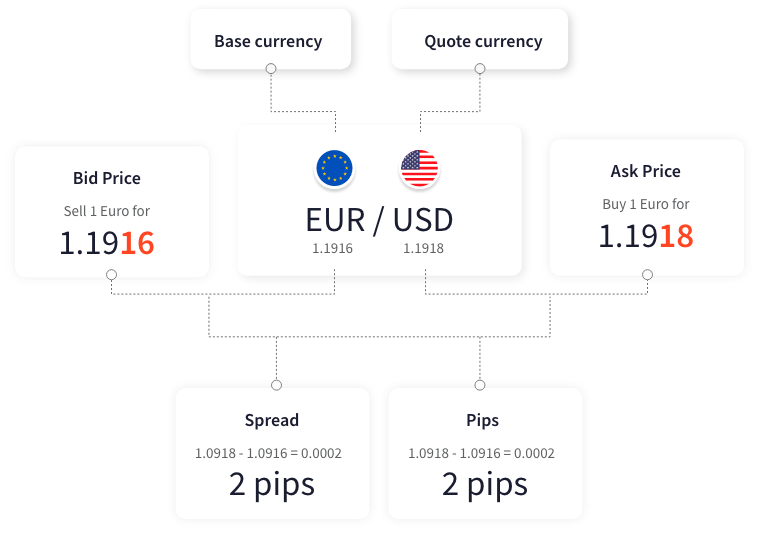

This 'currency pair' is made upward of a base of operations currency and a quote currency, whereby you sell ane to purchase some other. The price for a pair is how much of the quote currency it costs to buy one unit of the base currency. Yous tin can make a profit past correctly forecasting the price motion of a currency pair.

FXTM offers hundreds of combinations of currency pairs to trade including the majors which are the virtually popular traded pairs in the forex market. These include the Euro against the US Dollar, the United states of america Dollar confronting the Japanese Yen and the British Pound confronting the US Dollar.

The tabular array below looks at the most traded currency pair in the forex market.

For most currency pairs, a pip is the fourth decimal place, the master exception beingness the Japanese Yen where a pip is the second decimal place.

On the forex market place, trades in currencies are oftentimes worth millions, so small bid-ask price differences (i.e. several pips) can soon add together up to a pregnant profit. Of course, such large trading volumes mean a small spread can besides equate to significant losses.

Trading forex is risky, and so always trade advisedly and implement take chances management tools and techniques.

What are the most traded currency pairs on the forex market?

In that location are 7 major currency pairs traded in the forex market place, all of which include the US Dollar in the pair.

You can too trade crosses, which do not involve the USD, and exotic currency pairs which are historically less usually traded (and relatively illiquid). This ways they often come up with wider spreads, pregnant they're more expensive than crosses or majors.

Major currency pairs

Major currency pairs are more often than not thought to drive the forex marketplace. They are the about commonly traded and account for over 80% of daily forex trade volume.

In that location are four traditional majors – EURUSD, GBPUSD, USDJPY and USDCHF – and three known equally the commodity pairs – AUDUSD, USDCAD and NZDUSD.

These currency pairs typically take loftier liquidity, which means they tend to have lower spreads. They are associated with stable, well managed economies and are less prone to slippage, where the expected price of a merchandise differs from the toll the trade was executed at.

Cross currency pairs

Cross currency pairs, known equally crosses, practise not include the US Dollar. Historically, these pairs were converted commencement into USD and then into the desired currency - but are at present offered for direct exchange.

The most usually traded are derived from small currency pairs and can be less liquid than major currency pairs. Examples of the almost commonly traded crosses include EURGBP, EURCHF, and EURJPY.

Exotic currency pairs

Exotics are currencies from emerging or developing economies, paired with one major currency.

Compared to crosses and majors, exotics are traditionally riskier to trade considering they are more volatile and less liquid. This is because these countries' economies tin can be more susceptible to intervention and sudden shifts in political and financial developments.

What Is A Forex Account,

Source: https://www.forextime.com/education/forex-trading-for-beginners

Posted by: powerhazinge.blogspot.com

0 Response to "What Is A Forex Account"

Post a Comment