Myaccount King Invest Forex Matrix

- Is the gold trade risky?

- How do you trade in gold?

- Is trading golden profitable?

Many marketplace participants widely trade gold because information technology is among the volatile bolt in the forex market. Gilt is probably the near traded commodity in the world after oil, natural gas, and coffee.

As to metals, gold is the king. You tin can trade gold by using both technical and fundamental assay. We already accept some manufactures if y'all similar trading with indicators, toll action, or robo-counselor. If you desire to know how to trade gold using fundamentals, follow this commodity.

Let's dive into the main piece on how you lot can primary the primal strategy to merchandise gold before yous miss any excellent opportunity and fundamental news.

Brief about gold

Concrete golden has been in being since 2000 BC after the Egyptians started mining metals. Talking nigh the current global supply, it is over 189,000 tonnes.

XAU is the internationally accepted symbol for GOLD. XAU/USD in terms is the trading symbol of gold against the US dollar. Gilded is very like to all the other currency pairs, and here information technology is traded just similar any other asset in forex.

When you lot know briefly near gold, you might also want to know how and what affects its rate. Gold prices constantly keep changing, and many factors are behind it.

What affects the gilded rate on the exchange?

The gold market works primarily co-ordinate to its industrial supply and demand in the global market. Unlike whatsoever other currency, information technology can't dramatically increase or decrease when the government prints more paper currency.

Gold is i of the broadest (in terms of the influence of various factors) investment and speculative instruments. Many factors tin simultaneously influence the price during trading — supply/need, world news and news from central banks of countries, natural disasters, and currency movements.

Now you tin can imagine the volatility and adventure involved in trading aureate when then many factors affect it. A small-scale result tin cause a meaning move in this commodity, so gold is also a risky asset to trade.

Risks of trading gold

Trading in gold instruments carries the usual speculative and investment risks. Although metal is considered ane of the methods of long-term investments in any form — products, OMC, commutation instruments — it also knows how to draw long-term bearish trends.

Curt-term or medium-term trade in gilded is somewhat risky considering of its high volatility, merely at the same time, information technology as well gives an first-class opportunity to brand money. Take a chance, profit, and loss largely depend on your trading analysis, fashion, and techniques. You lot tin can use either technical or central analysis for trading gold.

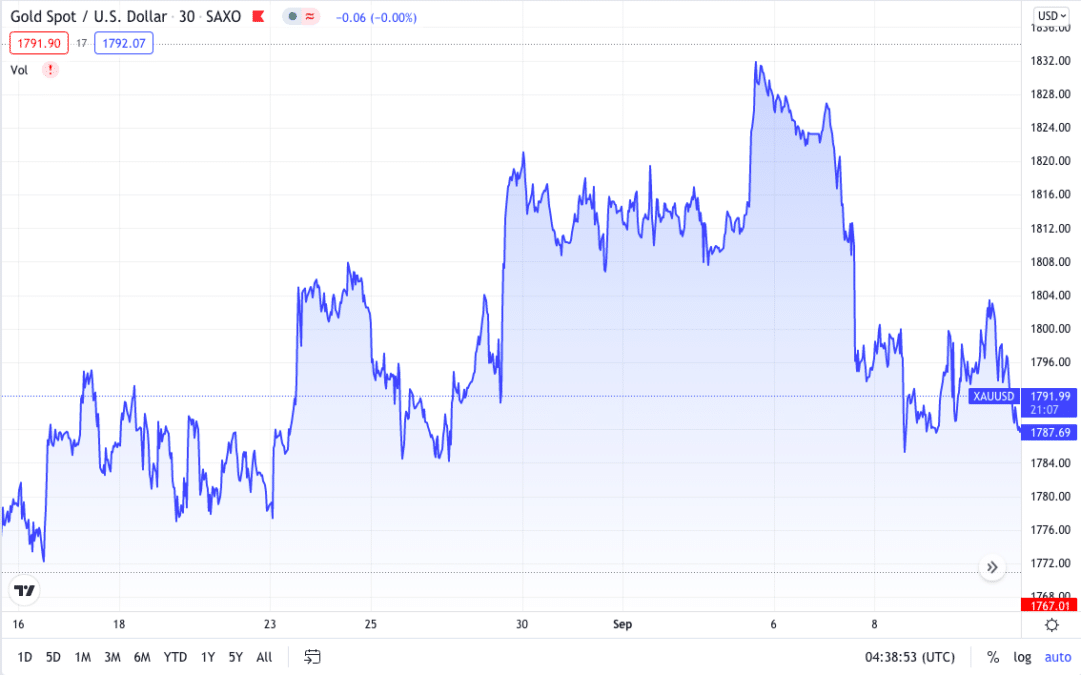

Let's wait at the chart. The historical data for spot gilt XAU/USD shows a significant spike, with the price pushing out to 850 in January 1980. A 20-year surly trend followed this until September 1999. Only then did the gold price opposite. At first, it was a rebound — after which the exchange value declined once again throughout 2000. Quotes confidently entered the bullish tendency only since April 2001.

What is key analysis?

Information technology is a method of breaking downwardly a country'southward economic, political, and social consequences and currency. In simpler terms, fundamental analysis is a trading technique wherein traders utilise news events to trade the market in simpler terms.

Past identifying the principal drivers of a currency's intrinsic value, forex participants can craft informed trading decisions. 1 of the ways to trade gold using fundamentals is by correlation, where traders can initially use such currencies or assets that are somehow related to gold.

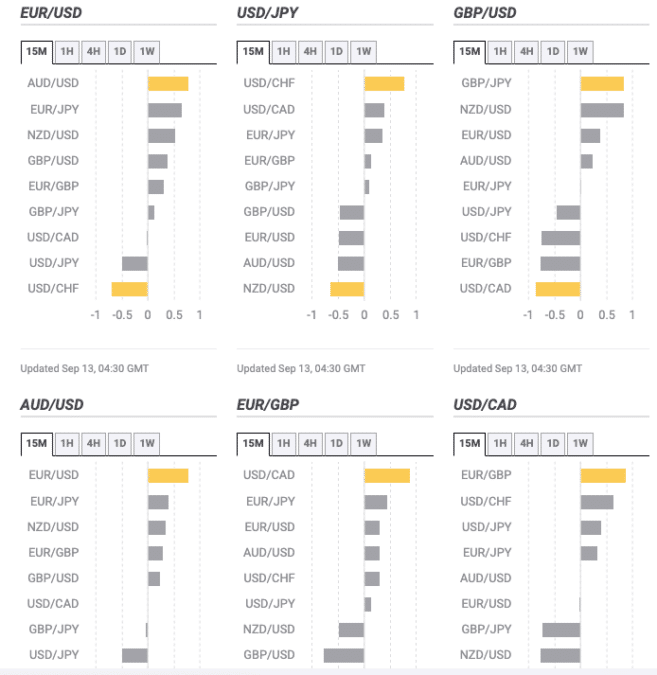

What is currency correlation?

The general definition of correlation is how 1 thing behaves similarly to the other. Likewise, currency correlation is a gauge of how ane currency pair is correlated in value and will move synchronically or counter in the FX market.

It is also a trading technique wherein traders clarify one currency pair and accept the same trade on another, closely correlated, and opposite merchandise in negatively correlated pairs.

If two currency pairs are positively correlated, they both will go up or downwardly in price similarly. At the same fourth dimension, if one currency is negatively correlated with the other, then 1 will appreciate and the other depreciate.

Examples of positive and negative correlations are:

- Positive correlation: AUD/USD and EUR/USD

- Negative correlation: EUR/GBP and GBP/USD

Trading gold using fundamentals correlation

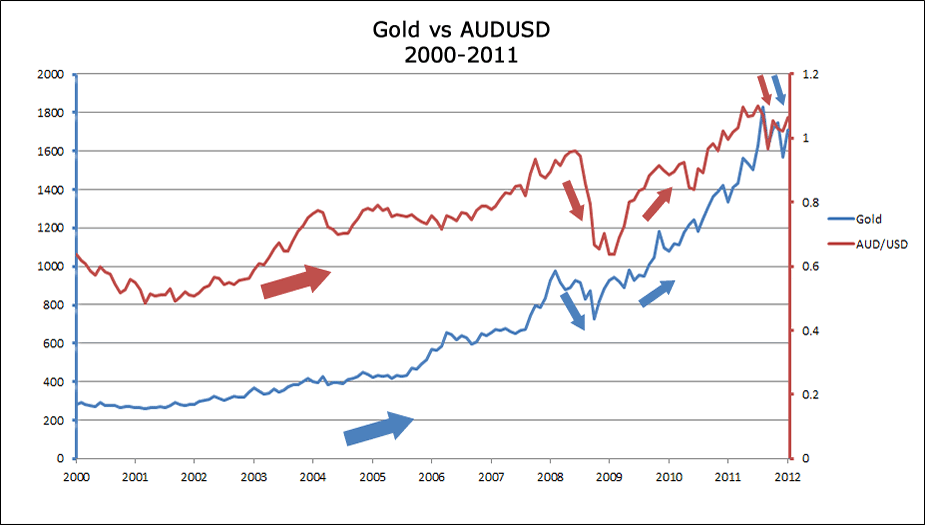

When you talk near currency correlation with gold, AUD/USD should exist the first pair that should strike in your heed. AUD/USD and gold are highly positively correlated with each other.

This means that if the AUD/USD moves up, the gilded moves upwards and vice-versa. Being positively correlated, you will find them moving in the same management near of the time, and only the divergence is the volatility.

These assets move in the aforementioned management because they both have USD associated at the back. That being said, you can make out that if the USD is gaining at a price, both the market gold and AUD/USD will move down, while if the USD is losing in price, both the gold and AUD/USD will go upwardly.

AUD/USD stands for price quotation of Aussie dollars concerning the The states dollar. On the other manus, aureate is USD per oz. If nosotros talk about gold mining, Australia is highly related to it. Gold mining in Western Australia is the 3rd-largest article sector. This makes AUD more inclined toward gold.

When the gold prices vary, information technology directly affects the amount bought and sold in AUD; this changes the supply and demand of AUD/USD in the global market. As you can run across, both the XAU and AUD have USD as a quote currency, which directly means these avails are affected by the rise and autumn of USD prices.

Trading the gold with USD correlations

XAU/USD is paired with USD; that being said, it is highly affected by any impact on USD.

USD and XAU are negatively correlated, meaning the prices of gold will go downwardly if the USD rises in price and vice-versa, in terms makes it a adept option for us to choose information technology to brand our strategy.

Allow usa learn and trade gold strategy with USD correlation. Many news events have an ambitious effect on USD; a few of them are the NFP on the kickoff Friday of every month, unemployment rate, initial jobless claims, GDP growth rate, and CPI.

Non-farm payroll

We will use an example of a recent NFP report and how information technology affected the XAU/USD pair.

The news that is released creates significant volatility in the FX market, particularly the USD pairs. And if the number is improve than the expectation, the Usa dollar becomes bullish. However, if the number is worse than expected, the US dollar is bearish.

To merchandise the NFP, you need to close all the running trades to make sure you are non on the wrong side of the market.

Scalping strategy case

- Move to the lower time frame, say 15min, and wait for 12:30 pm GMT.

- Practise non enter the trade immediately in one case yous see them move in a specific direction and wait for the entire candle to shut.

- Check the volume in the volume indicator.

- Once the candle is closed, if it is a surly candle, accept a sell position and if information technology is a bullish candle, take a buy position.

- Identify your stop loss by looking into a 5 min chart at five-6 pips away from the previous candle.

- Have profit when you are happy with your scalping merchandise at 1:2 R: R.

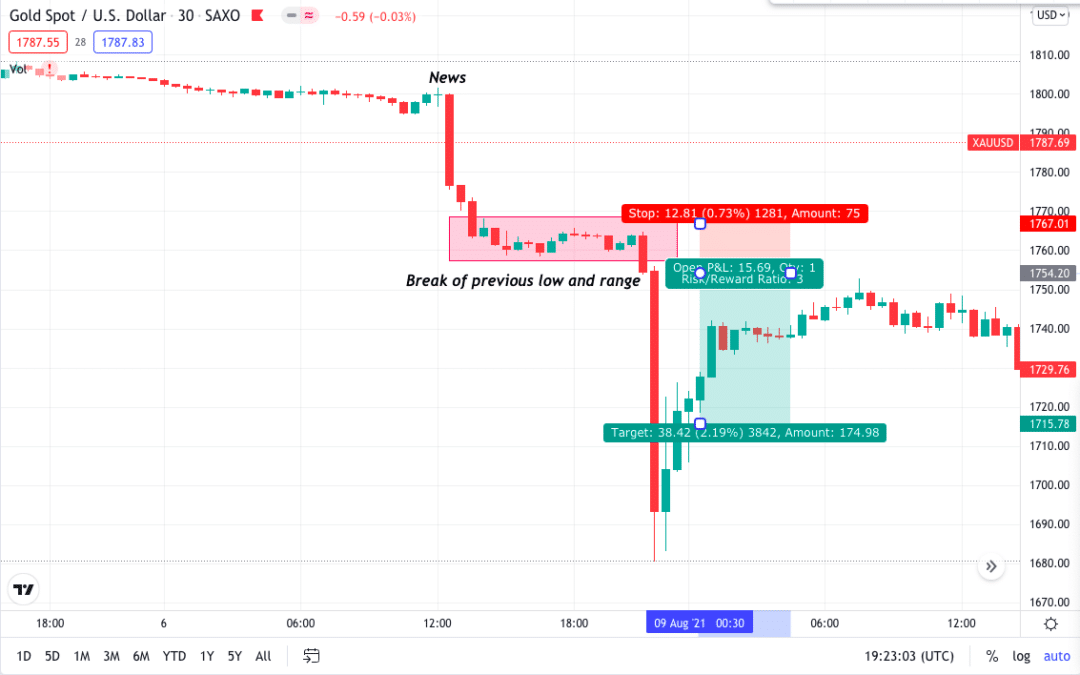

Solar day trading strategy instance

- Move to the 30min fourth dimension frame and expect for the market place to get in range.

- Expect for the breakout, and once you have it take the trade in the direction of the breakout.

- Place your terminate loss at 4-five pips away from the depression or high in example of sell/buy position.

- The take profit will be one:2 R: R.

In the below 30min fourth dimension frame, you tin can see the price breaking the range. Once the range is broken, you lot tin can take the merchandise afterward the previous candle is closed.

The NFP data was released on 6 August 2021, and the reading was 943,000. This number lags by one month; therefore, it means in July, 943,000 new jobs were added to the Us labor market.

Final thoughts

Trading gold is highly risky, primarily when it is traded with news such as NFP. There is a high risk of losing your majuscule, and so it is better to close the trade when you lot make a wrong merchandise entry.

According to many investors, gold and silver are assets that go on their money safety from inflation. The government has full authority to print coin, and when they print information technology also much, there is more than supply of it in the economic system, making it of less value in the market place. Gilded can be a good investment in these situations.

Source: https://investluck.com/xauusd-trading/

Posted by: powerhazinge.blogspot.com

0 Response to "Myaccount King Invest Forex Matrix"

Post a Comment